6 Easy Facts About Vancouver Accounting Firm Explained

Wiki Article

An Unbiased View of Outsourced Cfo Services

Table of ContentsRumored Buzz on Vancouver Accounting FirmVancouver Tax Accounting Company Things To Know Before You Get ThisOur Tax Consultant Vancouver IdeasGetting My Outsourced Cfo Services To Work

That takes place for every solitary transaction you make throughout a provided accounting duration. Working with an accountant can aid you hash out those information to make the bookkeeping process work for you.

You make changes to the journal entrances to make certain all the numbers add up. That might include making improvements to numbers or taking care of accrued products, which are costs or income that you sustain however do not yet pay for.

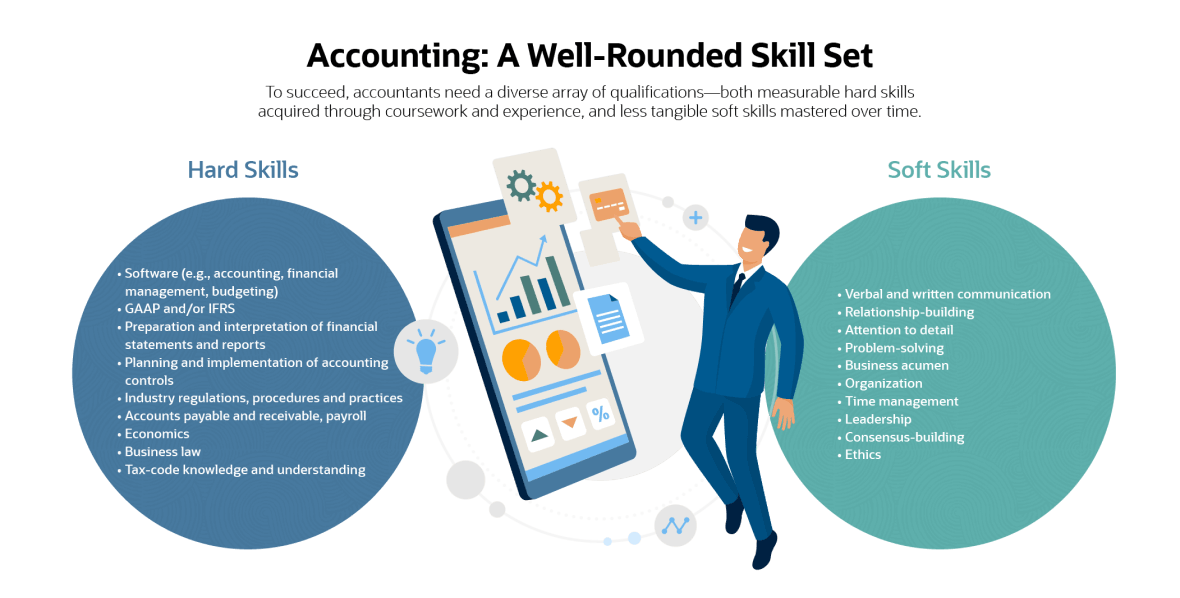

Accountants as well as accountants take the exact same foundational accountancy courses. This overview will certainly provide a comprehensive breakdown of what divides accountants from accounting professionals, so you can recognize which accounting role is the finest fit for your career ambitions currently and also in the future.

:max_bytes(150000):strip_icc()/dotdash-accounting-history-FINAL2-ed732e3d3f4e443288fbcc9a601fc23b.jpg)

9 Simple Techniques For Tax Consultant Vancouver

An accountant builds on the info given to them by the accountant. Normally, they'll: Evaluation monetary declarations prepared by an accountant. The records reported by the bookkeeper will establish the accounting professional's suggestions to leadership, and inevitably, the health of the service in general.e., federal government companies, colleges, healthcare facilities, etc). An educated and competent accountant with years of experience as well as first-hand understanding of accounting applications ismost likelymore certified to run the publications for your business than a recent accountancy significant grad. Keep this in mind when filtering applications; attempt not to evaluate applicants based upon their education alone.

Future forecasts as well as budgeting can make or damage your organization. Your monetary records will play a substantial duty when it involves this. Organization forecasts as well as patterns are based on your historic monetary data. They are needed to help ensure your service remains successful. The financial data is most dependable as well as accurate when supplied with a durable and structured bookkeeping procedure.

Vancouver Accounting Firm Things To Know Before You Get This

Accounting, in the typical feeling, has actually been around as lengthy as there has been commerce given that around 2600 B.C. An accountant's work is to keep total documents of all money that has entered into and also gone out of the organization - small business accounting service in Vancouver. Bookkeepers record daily purchases in a Pivot Advantage Accounting and Advisory Inc. in Vancouver regular, easy-to-read way. Their documents allow accountants to do their tasks.Normally, an accountant or proprietor supervises a bookkeeper's job. An accountant is not an accountant, nor should they be considered an accounting professional. Bookkeepers document monetary deals, blog post debits and also credit scores, produce invoices, take care of payroll and also preserve as well as balance guides. Bookkeepers aren't needed to be licensed to deal with guides for their consumers or company however licensing is readily available.

3 main factors impact your costs: the solutions you want, the expertise you need as well as your neighborhood market. The accounting services your organization needs as well as the amount of time it takes weekly or monthly to complete them impact exactly how much it costs to hire a bookkeeper. If you need somebody to find to the office when a month to resolve the publications, it will cost less than if you need to employ someone full-time to manage your daily procedures.

Based on that calculation, make a decision if you require to hire a person full time, part-time or on a task basis. If you have intricate publications or are bringing in a lot of sales, employ a certified or accredited bookkeeper. A knowledgeable bookkeeper can give you comfort and confidence that your funds remain in excellent hands but they will additionally cost you much more.

Vancouver Tax Accounting Company Fundamentals Explained

If you live in a high-wage state like New York, you'll pay even more for an accountant than you would certainly in South Dakota. There are a number of benefits to working with an accountant to submit as well as document your service's economic records.

Then, they may seek added qualifications, such as the CPA. Accounting professionals may also hold the placement of bookkeeper. If your accounting professional does your bookkeeping, you may be paying even more than you should for this service as you would usually pay even more per hour for an accounting professional than an accountant.

To finish the program, accounting professionals should have four years of appropriate job experience. CFAs must additionally pass a challenging three-part test that had a pass price of only 39 percent in September 2021 - Vancouver tax accounting company. The point right here is that employing a CFA indicates bringing very innovative accountancy expertise to your company.

To obtain this accreditation, an accountant should pass the called for tests and also have two years of specialist experience. Certified public accountants can execute some of the very same services as CIAs. However, you might hire a CIA if you desire a more specialized concentrate on financial danger analysis and protection tracking procedures. According to the BLS, the typical income for an accounting professional in 2021 was $77,250 each year or $37.

Report this wiki page